Wyandotte County Property Tax Rate . wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). Tax rate is measured in mills. county library levy rate usd #203 levy rate kckcc levy rate kaw valley drainage dist. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. library rates state county twsp school college dist. all taxable real and personal property within the ug is assessed annually by the county appraiser. Levy rate pub libary brd =9.827377.

from sentinelksmo.org

Tax rate is measured in mills. all taxable real and personal property within the ug is assessed annually by the county appraiser. county library levy rate usd #203 levy rate kckcc levy rate kaw valley drainage dist. wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. Levy rate pub libary brd =9.827377. library rates state county twsp school college dist.

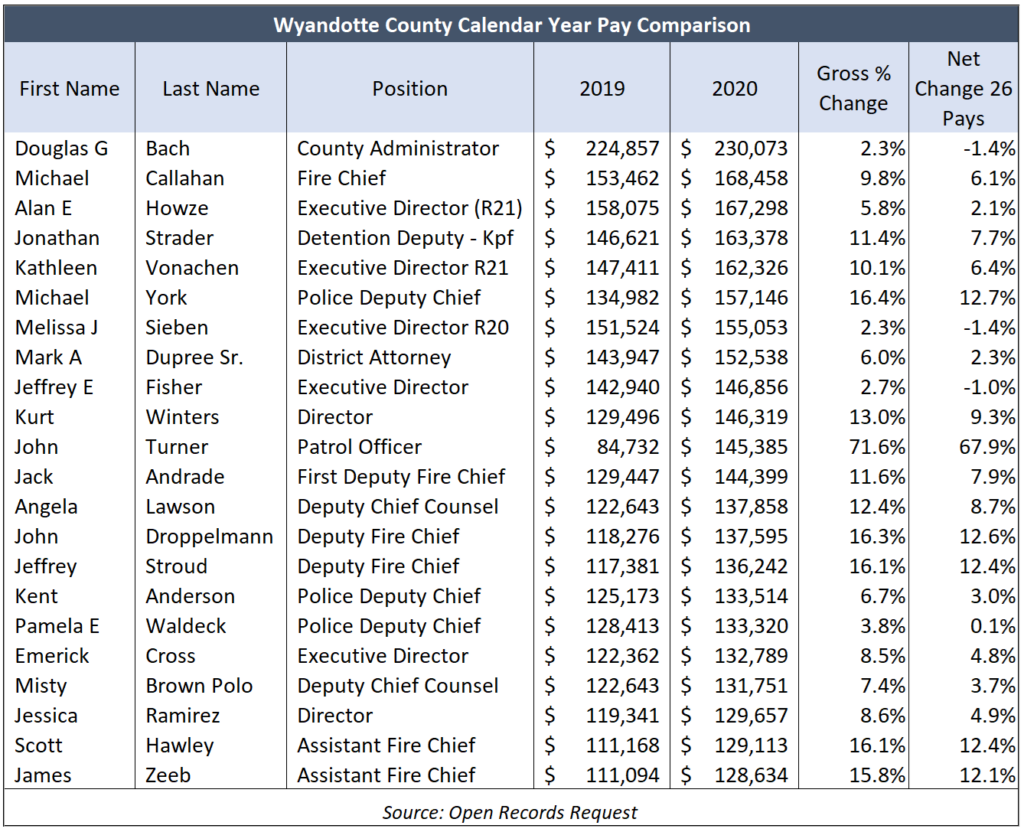

Wyandotte County officials won't discuss 2020 pay increases The Sentinel

Wyandotte County Property Tax Rate the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). county library levy rate usd #203 levy rate kckcc levy rate kaw valley drainage dist. library rates state county twsp school college dist. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,. Levy rate pub libary brd =9.827377. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. all taxable real and personal property within the ug is assessed annually by the county appraiser. Tax rate is measured in mills.

From patch.com

Free Tax Preparation Available in Wyandotte Wyandotte, MI Patch Wyandotte County Property Tax Rate 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. library rates state county twsp school college dist. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. Tax rate is measured in mills.. Wyandotte County Property Tax Rate.

From www.templateroller.com

Wyandotte County, Kansas Vehicle Bill of Sale Fill Out, Sign Online Wyandotte County Property Tax Rate all taxable real and personal property within the ug is assessed annually by the county appraiser. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,. Tax rate is measured in mills. wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). Levy rate pub libary brd =9.827377. county library levy rate. Wyandotte County Property Tax Rate.

From www.niche.com

2020 Best Places to Buy a House in Wyandotte County, KS Niche Wyandotte County Property Tax Rate the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. Tax rate is measured in mills. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,.. Wyandotte County Property Tax Rate.

From wenonawjolie.pages.dev

San Diego County Property Tax Rate 2024 Brenn Kellyann Wyandotte County Property Tax Rate county library levy rate usd #203 levy rate kckcc levy rate kaw valley drainage dist. Levy rate pub libary brd =9.827377. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. all taxable real and personal property within the ug is assessed annually by. Wyandotte County Property Tax Rate.

From dwellics.com

Safety in Ridge township (Wyandot County), Ohio (crime rates and Wyandotte County Property Tax Rate the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. Tax rate is measured in mills. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per.. Wyandotte County Property Tax Rate.

From www.kshb.com

WyCo leaders balance debt with help from property owners Wyandotte County Property Tax Rate library rates state county twsp school college dist. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,. county library levy rate usd #203 levy rate kckcc levy rate kaw valley drainage dist. wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). the median property tax (also known as real. Wyandotte County Property Tax Rate.

From explorekansas.blogspot.com

Explore Kansas May 2013 Wyandotte County Property Tax Rate 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. library rates state county twsp school college dist. Tax rate is measured in mills. Levy rate pub libary brd =9.827377. wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). . Wyandotte County Property Tax Rate.

From movedownriver.com

Wyandotte Wyandotte County Property Tax Rate Levy rate pub libary brd =9.827377. Tax rate is measured in mills. county library levy rate usd #203 levy rate kckcc levy rate kaw valley drainage dist. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1,. Wyandotte County Property Tax Rate.

From www.wyedc.org

Housing in Wyandotte County, KS Wyandotte County Property Tax Rate county library levy rate usd #203 levy rate kckcc levy rate kaw valley drainage dist. Levy rate pub libary brd =9.827377. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. Tax rate is measured in mills. the median property tax (also known as real estate tax). Wyandotte County Property Tax Rate.

From appr.wycokck.org

Wyandotte Public Access > Property Detail Wyandotte County Property Tax Rate the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). Levy rate pub libary brd =9.827377. county library levy rate usd #203 levy rate kckcc levy rate kaw. Wyandotte County Property Tax Rate.

From www.co.wyandot.oh.us

Survey & Tax Map Downloads Wyandot County, OH Wyandotte County Property Tax Rate 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. all taxable real and personal property within the ug is assessed annually by the county appraiser. library rates state county twsp school college dist. Levy rate pub libary brd =9.827377. county library levy rate usd #203. Wyandotte County Property Tax Rate.

From studylib.net

2015 Budget News Release Unified Government of Wyandotte Wyandotte County Property Tax Rate wyandotte county (1.54%) has a 14.9% higher property tax rate than the average of kansas (1.34%). all taxable real and personal property within the ug is assessed annually by the county appraiser. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. Library 010 1, 1a, 1aa,. Wyandotte County Property Tax Rate.

From www.realtor.com

114 Oak St, Wyandotte, MI 48192 Wyandotte County Property Tax Rate Levy rate pub libary brd =9.827377. all taxable real and personal property within the ug is assessed annually by the county appraiser. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00. Wyandotte County Property Tax Rate.

From www.etsy.com

Vintage Wyandotte County Map 1887 Old Map of Wyandotte Etsy Wyandotte County Property Tax Rate library rates state county twsp school college dist. Levy rate pub libary brd =9.827377. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per.. Wyandotte County Property Tax Rate.

From artsourceinternational.com

McNally's 1923 Map of Wyandotte County, Kansas Art Source International Wyandotte County Property Tax Rate library rates state county twsp school college dist. Levy rate pub libary brd =9.827377. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. all taxable real and personal property within the ug is assessed annually by the county appraiser. county library levy. Wyandotte County Property Tax Rate.

From sentinelksmo.org

Wyandotte County officials won't discuss 2020 pay increases The Sentinel Wyandotte County Property Tax Rate Tax rate is measured in mills. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. Levy rate pub libary brd =9.827377. library rates. Wyandotte County Property Tax Rate.

From www.co.wyandot.oh.us

Survey & Tax Map Downloads Wyandot County, OH Wyandotte County Property Tax Rate 2023 real and personal property value and tax summary 105 wyandotte county value and tax total taxable value value per. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. Tax rate is measured in mills. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,.. Wyandotte County Property Tax Rate.

From www.niche.com

School Districts in Wyandotte County, KS Niche Wyandotte County Property Tax Rate Tax rate is measured in mills. Library 010 1, 1a, 1aa, 1b, 1c, 1ff1, 1gg,. Levy rate pub libary brd =9.827377. library rates state county twsp school college dist. the median property tax (also known as real estate tax) in wyandotte county is $1,599.00 per year, based on a median home value. all taxable real and personal. Wyandotte County Property Tax Rate.